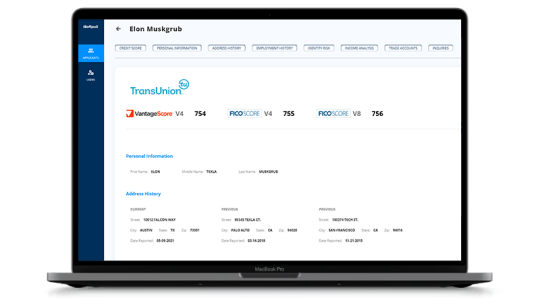

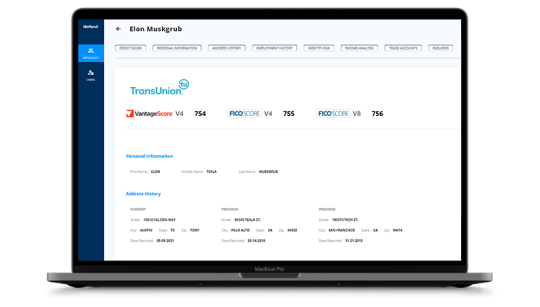

Instantly view your customer's full credit report and FICO® Score

Just a few of our clients…

Don't just guess your customer's credit score... run a soft pull!

Stop spending time and money on unqualified leads.

The data provided on a soft pull is the exact same information as a hard pull

What is the difference between a hard pull and a soft pull? It is not the underlying data! The difference is in the purpose of the pull. A soft pull is used to prequalify a customer for financing; a hard pull is used to transact a loan.

See How This Works >Authorized Resellers

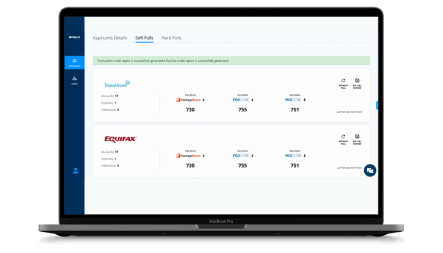

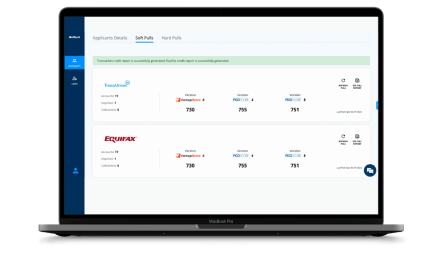

iSoftpull is a proud partner of Equifax and TransUnion— delivering their proprietary data through our software to businesses wanting to prequalify their customer's for financing. FICO® Scores can be appended to any credit report.

Automate your

pre-qualification

process with iSoftpull's Integration Suite

Enhance your business processes with iSoftpull's selection of easy-to-implement credit reporting APIs

Learn More >This is what iSoftpull will do...

Save You Time

Determine if your prospect qualifies at the beginning of the sales cycle so you which ones have the conditions to close

Save You Money

Save on payroll, ad spend, operations, cost of losing out on qualified opportunities, etc.

Increase Revenue

Spend more time on deals that have the credit condition to qualify